作者:Vijay Boyapati

发布时间:2020年6月23日

微博:SaharaAnt

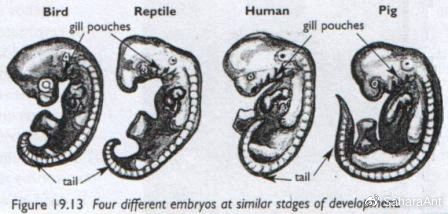

1/ In their embryonic form many species appear alike. But imprinted in their various DNAs is the code that will evince their great differences in the fullness of time.

A thread on the great debate about what #Bitcoin is and why only one of the two major visions makes sense

许多物种在胚胎形态上看起来很相似。但印在他们不同的DNA中的是一个密码,它将在时间的充分性上显示他们的巨大差异。

关于比特币是什么以及为什么只有两个主要观点中的一个有意义的大辩论

2/ In its first few years #Bitcoin appeared to be both a disruptive payment rail (near zero transaction fees) and a promising store of value (dramatically increasing in value over time).

Yet written in the code that powered its network were rules that guaranteed only one outcome

2/在最初的几年里,比特币似乎既是一种颠覆性的支付渠道(接近零交易费用),又是一种有希望的价值存储(随着时间的推移价值急剧增加)。

然而,用支持其网络的代码编写的规则只能保证一个结果

ps.确实比特币在前期一直是往支付这条路上探索

3/ #Bitcoin’s “consensus rules” are the set of rules agreed upon by all computers running on the Bitcoin network. Only those computers abiding by these rules are accepted as a part of the network. Perhaps the most famous rule is the number of bitcoins that are created per block.

3/#比特币的“共识规则”是运行在比特币网络上的所有计算机商定的一套规则。只有那些遵守这些规则的计算机才被接受为网络的一部分。也许最著名的规则是每一区块产出的比特币数量。

4/ #Bitcoin’s consensus rules are, by the game theoretic nature of the network, incredibly difficult to change. To change a rule would require the agreement of overwhelming majority of computers running on the network.

4/根据网络的博弈论性质,比特币的共识规则难以改变。要改变规则,需要绝大多数运行在网络上的计算机的同意。

5/ From a purely software perspective, the difficulty of changing #Bitcoin’s rules and core parameters might seem like a disadvantage that would eventually consign Bitcoin into obsolescence. Rather the difficulty preserves Bitcoin’s most valuable property:

5/从纯软件的角度来看,改变比特币规则和核心参数的难度似乎是一个不利因素,最终会导致比特币过时。相反,这一困难保留了比特币最有价值的特性:

6/ Fundamentally, demand for bitcoins arises from the scarcity of supply (no more than 21 million will ever be created). Yet belief in the scarcity of #Bitcoin’s supply rests completely on the credibility of its monetary policy. If easily changed, that policy has no credibility.

6/从根本上说,比特币的需求源于供应不足(将创造不超过2100万个比特币)。然而,对比特币供应短缺的信心完全取决于其货币政策的可信度。如果很容易改变,这项政策就没有可信度。

7/ Much like a protocol, such as TCP/IP, or the shape and specification of a power socket, changing Bitcoin’s consensus rules with a “hard fork” would come at great cost, ultimately destroying Bitcoin’s core value proposition.

7/很像TCP/IP等协议,或者电源插座的形状和规格,用“硬叉”改变比特币的共识规则将付出巨大代价,最终摧毁比特币的核心价值主张。

8/ Given the necessary difficulty of changing #Bitcoin’s rules – in particular the number of transactions that can be processed per block – it becomes clear that as demand for Bitcoin increases, eventually fees per transaction must rise.

8/鉴于改变比特币规则的必要困难,特别是每个区块可以处理的交易数量,很明显,随着比特币需求的增加,最终每笔交易的费用必须上升。

9/ Growing fees and a limit to the number of transactions processed per block implies that under widespread adoption, #Bitcoin would simply be uneconomical for use in global daily commercial transactions (such as purchasing bread). Yet its purpose is so much larger…

9/不断增长的费用和对每个区块处理的交易数量的限制意味着,在广泛采用的情况下,比特币在全球日常商业交易(如购买面包)中使用是不经济的。但它的目的更大。。。

10/ … #Bitcoin is perfectly suited as a global monetary base, much as gold was in the 19th century, providing a means of final settlement between large financial institutions and large-scale value transfer.

10/。。。#比特币非常适合作为全球货币基础,就像19世纪的黄金一样,它为大型金融机构之间的最终结算和大规模价值转移提供了一种手段。

11/ As a global monetary base, a #Bitcoin standard would be far superior to a gold standard with all the problems that are attendant of gold’s physicality

– Costliness of security and transportation

– Difficulty of assaying

– Centralization of storage (enabling confiscation)

11/作为一个全球货币基准,比特币标准将远远优于黄金标准,因为黄金的物质性伴随着所有的问题

-安全和运输成本

-拆分困难

-集中存储(允许没收)

12/ We are still very early in #Bitcoin’s path to becoming a global monetary base. This presents an odd situation where individuals can still own large fractions of this base. It’s almost as peculiar as regular people owning 100 kilogram gold bricks under a gold standard.

12/我们在比特币成为全球货币基准的道路上还很早。这就出现了一种奇怪的情况,在这种情况下,个人仍然可以拥有这个基数的很大一部分。这几乎和普通人按照黄金标准拥有100公斤的金砖一样奇特。

13/ As #Bitcoin’s price continues to rise, large HODLers of its supply will have a powerful incentive to diversify their appreciated bitcoins into other assets (such as homes/stocks/bonds/sports teams etc) and thus the supply will slowly but surely be distributed.

13/随着比特币价格的持续上涨,大量的比特币供应者将有强大的动力将其增值的比特币多样化为其他资产(如房屋/股票/债券/运动队等),因此供应将缓慢但肯定地分配。

14/ Eventually, most people will have ownership of very small fractions of the monetary base via financial institutions. These institutions will use the #Bitcoin network as a means of final settlement between each other. Hal Finney (RIP) was the first to understand this:

14/最终,大多数人都将通过金融机构拥有一小部分货币基准的所有权。这些机构将使用比特币网络作为彼此之间的最终结算手段。哈尔·芬尼(Hal Finney,RIP)是第一个明白这一点的人:

15/ In this final stage of #Bitcoin’s evolution it will become the backbone of a new much more robust and less corruptible financial system. And so Bitcoin’s DNA – its consensus rules – will finally make clear what it is. Not a payment rail but a new, far superior, monetary base.

15/在比特币进化的最后阶段,它将成为一个新的更加强大和不易腐败的金融体系的支柱。因此,比特币的DNA——它的共识规则——将最终明确它是什么。不是一个支付,而是一个新的,优越得多的,货币基准。